Today’s Key Takeaways: Carbon-free power sector sees slowest quarter since 2019. Invisible hand of free market isn’t working like it used to with oil supply and demand. U.S. natural gas futures jumped 7% today. Electrokinetic technology could offer cleaner alternative for mining. Biden’s windfall tax on oil more bluster than threat.

NEWS OF THE DAY:

CLEAN POWER GROWTH SLOWED: The carbon-free power sector is coming out of a disappointing third quarter, but industry leaders said they are hopeful the Inflation Reduction Act’s generous subsidies for green energy will turn things around over time.

The American Clean Power Association, which represents wind, solar, and storage companies, announced Q3 performance metrics this morning. New installations were down 22% compared to the same period last year, making for the slowest quarter since Q3 of 2019.

A year of challenges: The wind and solar sectors have faced common challenges affecting other industries, such as inflation and supply chain constraints.

Alongside materials and shipping costs pressures, solar developers in particular say they have seen supply disruptions associated with the Commerce Department’s ongoing anti-circumvention investigation into solar imports from Asia.

Although President Joe Biden intervened during the summer to ensure no new tariffs would be imposed for two years, new installations have underperformed expectations, and solar made up the largest share of project delays for the quarter, ACP said.

Bright spots: Q3 performance is “not all doom and gloom,” JC Sandberg, ACP’s interim CEO, told reporters this morning.

Sandberg pointed to growth in battery storage installations, which saw their second strongest quarter on record.

Overall, ACP said the pace of new installations is expected to quicken over the decade thanks to the IRA’s provisions, anticipating 550 GW of new generating capacity by 2030.

John Hensley, ACP’s vice president of research & analytics, stressed the need for Treasury to quickly finalize guidance about how it will implement revamped production and investment tax credits. He emphasized that benefits will take time to materialize.

“While we do see that the IRA has delivered on tax policy certainty the industry has requested, it will take some time for this to be reflected in the market,” Hensley said.

From the Washington Examiner, Daily on Energy

OIL:

We Told Big Oil Not to Invest. Don’t Complain Now

Javier Blas, Bloomberg, November 1, 2022

The cure for high oil prices is high prices, or so says the commodity industry’s adage. Let the invisible hand of the free market work its magic. High prices will simultaneously reduce demand and increase supply, eventually making the good less expensive.

This has proven true for centuries: In commodities, a bust follows every boom. It happened after the Klondike Gold Rush in 1896, during the second oil crisis in 1979 and following the most recent US shale boom a decade ago. Generations of petroleum engineers, geologists and financiers have grown up swearing by it.

But the axiom no longer seems to be governing the oil market.

To be sure, the elevated cost of crude is suppressing appetite. But the other side of the equation — supply — isn’t working out. The industry simply hasn’t been reacting to high prices with more investment as it has before. This means demand will have to do all the work to rebalance the oil market. The result is likely to be a slower economy and more sustained energy costs than in the past.

Why isn’t the supply lever working? Money certainly isn’t the problem. Big Oil has reported its best-ever six-month period, earning more than $100 billion in profits from April to September. Exxon Mobil Corp. just enjoyed its best quarter in its 152-year history, which goes all the way back to John D. Rockefeller.

Neither Exxon nor its competitors Chevron Corp., Shell Plc, TotalEnergies SE and BP Plc have announced any major increases in spending beyond what they have already planned. Institutional investors, led by BlackRock Inc., have convinced virtually every oil executive to keep spending under control. Pierre Breber, the chief financial officer at Chevron, put it this way: “We’re not really paid for growth by the market.” Instead, they are channeling the profits into dividends and share buy backs.

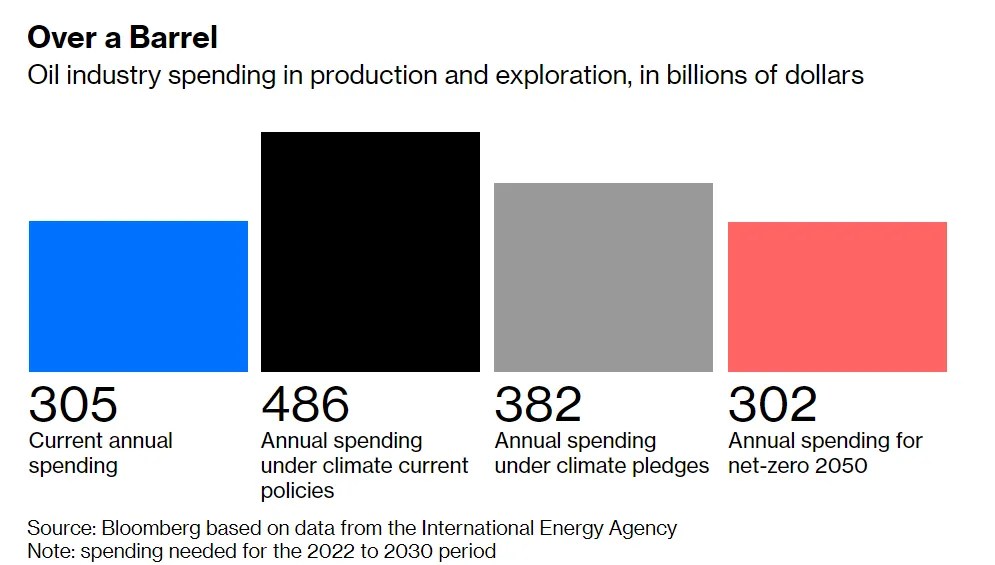

In the past, some executives would have tried to kickstart a boom-to-bust cycle: Boost spending early, increase production and then cash in before prices crashed. Today, the pressure from shareholders to remain frugal is so strong and uniform across the industry that from the outside it almost looks like a cartel. And the result is cartel-like: Big Oil is collectively underinvesting by a lot.

GAS:

U.S. natgas jumps 7% in volatile week with Freeport LNG seen back soon

Reuters/Yahoo! Finance, November 2, 2022

U.S. natural gas futures jumped about 7% on Wednesday during what has already been an extremely volatile week of trade on a drop in output at the start of the month and expectations gas demand will rise once the Freeport liquefied natural gas (LNG) export plant in Texas exits an outage.

That price increase came despite forecasts lower demand over the next two weeks with the weather expected to remain mild through at least mid-November.

That should allow utilities to keep adding gas into storage for a few weeks beyond the usual Oct. 31 end of the injection season.

Freeport LNG expects its 2.1-billion-cubic-feet-per-day (bcfd) export plant to return to at least partial service in early- to mid-November following an unexpected shutdown on June 8 caused by a pipeline explosion.

MINING:

It’s electric! Technique could clean up mining of valuable rare earth elements

Dennis Normile, November 1, 2022, Science

Electric cars, wind turbines, and LED lighting all help keep the environment clean, but making them can be a dirty business. The high-performance magnets in motors and generators and the glowing phosphors in LEDs and flat screens all depend on substances called rare earth elements (REEs). And capturing REEs from the clay deposits in which many are found requires leaching agents that pollute soil and groundwater.

Now, a Chinese group has developed—and tested on tons of soil—an approach called electrokinetic mining that relies on electric currents to free the REEs, sharply reducing the need for polluting chemicals. The strategy, described this week in Nature Sustainability, could be “a game changer, providing that it is feasible at a large scale,” says Anouk Borst, a geologist at KU Leuven.

Gaofeng Wang of the Chinese Academy of Sciences’s Guangzhou Institute of Geochemistry (GIG) and his colleagues thought electrokinetic technology might offer a cleaner alternative. The approach, in which electrodes on the top and bottom of a volume of soil induce an electric field, speeding the movement of the leaching agent and the ions it extracts, is already used in soil remediation and has been proposed for copper and gold mining. It has “the real potential to outperform traditional mining techniques in terms of efficiency, environmental impacts, and economics,” says Riccardo Sprocati, a specialist in the technology at the Technical University of Denmark.

POLITICS:

Windfall Tax On Big Oil Is More Politics Than Real Threat

Ari Nater, Jennifer A. Dlouhy, Bloomberg/Rigzone, November 2, 2022

President Joe Biden’s threat to slap a tax on oil-company profits is more bluster than a threat as the clock runs out on the administration’s efforts to tame fuel prices ahead of midterm elections.

Democrats have tried, and failed, for more than a decade to impose a so-called “windfall” tax on oil companies without success. With an evenly divided Senate and an eight-seat majority in the House looking increasingly vulnerable, Biden’s threat to tax what he described as the industry’s “windfall of war” will be nearly impossible to achieve.

This should be viewed “as a political message ahead of the midterms rather than a serious policy proposal with the potential to become law,” Height Securities LLC said in a note to clients Tuesday. “The proposal primarily serves as a means to deflect Republican attacks blaming the Biden administration for high fuel prices and inflation, which are central to voters’ concerns heading into the midterms but that the administration has little power to change,” the note said.

Biden’s remarks Monday come as oil companies such as Exxon Mobil Corp, Shell Plc and TotalEnergies SE smash records with multibillion-dollar profits in the second quarter, making them easy targets for a White House struggling to contain gas prices that remain at historically elevated levels.