Today’s Key Takeaways: Santos acquires partners on North Slope exploration leases. Fundamentals or momentum driving oil prices? Japan needs more LNG. No quick fix for the energy transition.

NEWS OF THE DAY:

SANTOS TO FARM DOWN EXPLORATION LEASES IN ALASKA

Santos, September 19, 2023

Consistent with its Alaska strategy to focus on the Pikka development, Santos today announced it will farm-down half of its working interest in 148 exploration leases (more than 270 thousand acres of State of Alaska lands) on the Alaska North Slope in an agreement with APA Alaska LLC1 and Lagniappe Alaska LLC2.

The leases are located on the eastern North Slope with multiple prospects in the late Cretaceous Brookian and Schrader Bluff formations. Under the terms of the farm-down agreement, initial activities during the exploration phase will be undertaken without cost to Santos.

Santos acquired the acreage as part of its merger with Oil Search in 2021. The farm-down is subject to customary government approvals.

Santos Managing Director and CEO Kevin Gallagher said he was delighted that Santos has been able to optimise its working interest in its Alaskan acreage in line with the strategy to focus on development of the Pikka project.

“I am pleased we’ve reached this agreement to farm down our exploration assets in Alaska. This transaction demonstrates the continued level of interest in exploration and development projects in the region, a tier one jurisdiction with supportive stakeholders and prospective undeveloped acreage,” Mr Gallagher said.

“We look forward to working with our partners on the North Slope and continuing to build strong relationships together as we continue to develop and optimise our Alaskan business.”

Following execution of the farm down agreement Santos working interest will be 25 percent.

1. APA Alaska LLC is a subsidiary of APA Corporation

2. Lagniappe Alaska, LLC is a subsidiary of Armstrong Oil & Gas.

OIL:

Oil Heads For $100. Fundamentals Or Momentum Trading?

Michael Lynch, Forbes, September 20, 2023

The surge in oil prices caught some by surprise, but many observers had been warning for months of such an outcome, especially as the IEA repeatedly forecast market tightening in the second half of the year. Post-pandemic economic growth is expected to raise demand, OPEC+ quotas are restricting supply, war in the Ukraine has made Russian exports uncertain, and U.S. shale production appears to be slowing. What perplexed many is that all of this has been forecast for months but prices did not respond until recently.

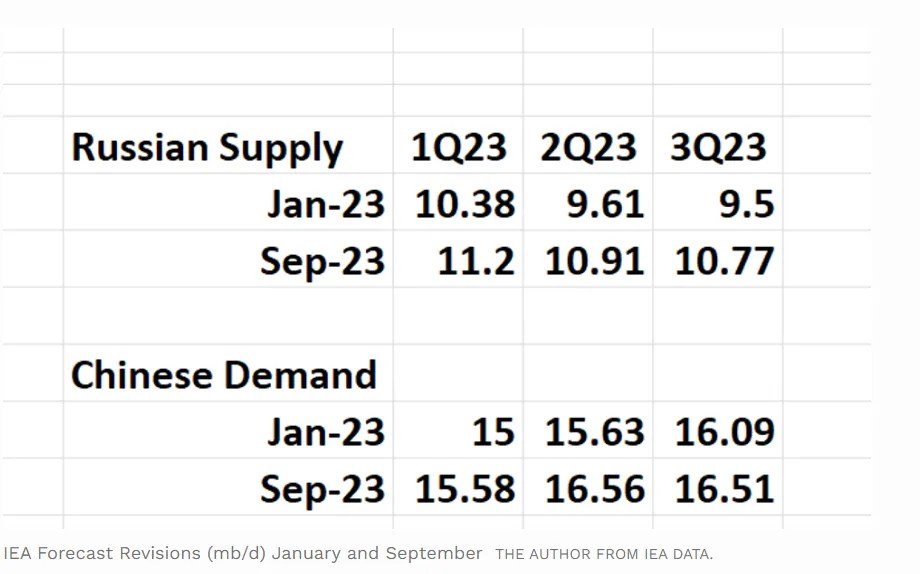

Of course, things have not played out as predicted by the IEA (note, they never do and never will, and not just for the IEA but everyone). The table below compares the IEA’s forecast from the January and September Oil Market Reports for Russian oil supply and Chinese oil demand and the revisions are significant—but offsetting. Russia supply is running about 1 mb/d ahead of earlier expectations, while Chinese demand is also about 700 tb/d higher.

GAS:

Japan’s Dwindling LNG Inventories Could Prompt New Purchases

Stephen Stapczynski, Shoko Oda, BNN Bloomberg, September 20, 2023

Japan’s liquefied natural gas inventories dropped to the lowest level in over a year-and-a-half and could push the nation’s utilities to buy more fuel ahead of winter.

Storage held by Japan’s power suppliers fell to 1.62 million tons as of Sept. 17, according to data compiled by the trade ministry. That’s the least since March 2022.

The country’s utilities have already started to stock up on gas ahead of winter with some LNG purchases from the spot market over the last few weeks. Any more prolonged effort to buy additional cargoes would help to tighten the global market and likely send prices higher.

Lingering hot weather has helped drain Japan’s stores of natural gas. The country’s Meteorological Agency forecasts temperatures to be warmer-than-normal across most areas through Oct. 15.

Spot power prices in the nation on Wednesday rose to the highest since February as utilities limit some electricity sales to help conserve gas supplies. Electricity sales volumes dipped 15% on Tuesday from a day earlier, falling well below demand, according to data from the Japan Electric Power Exchange.

POLITICS:

Peak oil demand view ‘wilting under scrutiny,’ Aramco CEO says

Bloomberg, September 19, 2023

Continued usage makes it “dangerous” to try to phase out fossil fuels too quickly, Amin Nasser said.

Saudi Aramco CEO Amin Nasser said forecasts that oil usage will peak soon have been proven to be unrealistic.

“This notion is also wilting under scrutiny because it’s mostly being driven by policies rather than the proven combination of markets, competitive economics and technology,” Nasser said at the World Petroleum Congress in Calgary, Alberta.

Oil demand will rise to a record of 103 million to 104 million barrels a day in the second half of the year, he said. That continued usage makes it “dangerous” to try to phase out fossil fuels too quickly, he said.

“There is no quick fix” for the energy transition, Nasser said.