NEWS OF THE DAY:

“Differences in policies and political values won’t recede with the virus, and it’s clear from the census data which side is winning the contest for talent and taxpayers.”

The Great Pandemic Migration

The Editorial Board, The Wall Street Journal, December 30, 2021

The pandemic has changed America in many ways, and one major change is the migration from states that locked down their economies and schools the most to those that kept them largely open.

That’s the underreported news in last week’s Census Bureau state population and domestic migration estimates from July 1, 2020, to July 1, 2021. Data used for this year’s Congressional reapportionment was based on where people claimed to live on April 1, 2020. But what a difference 15 months of lockdowns made.

Illinois’s population declined by another 141,039 between spring 2020 and this past summer as 151,512 people on net left the state for other states. California lost 300,387 amid a net out-migration of 429,283 residents. The biggest loser—you already know this—was New York, whose population shrunk 365,336 due to an outflow of 406,257 residents.

On the other hand, Texas added 382,436 new residents, including 211,289 from other states. Florida gained 242,941 in population as 263,958 people from other states flooded in. Florida’s population growth would have been greater if not for the high number of Covid deaths, which is a result of its older population. Same for Arizona whose population grew by 124,814.

Migration from high- to low-tax states—especially those in the Sun Belt—has been going on for well over a decade. But the trend picked up during the pandemic, as Democratic states tended to impose the strictest lockdowns and school closures while those governed by Republicans allowed most businesses and schools to stay open after spring 2020.

California’s net outflow surged 75% between July 1, 2020, and July 1, 2021, compared to the same period from 2018 to 2019. New York’s out-migration doubled. On the other hand, Texas’s inflow increased by 40%, and Florida’s swelled by more than half. The flight out of Illinois also accelerated.

Connecticut for the first time since 2011 had a net increase in migration from other states. That’s probably due to many New York office workers moving as employers in Manhattan shifted to remote work. But Democratic Gov. Ned Lamont also pushed to keep schools open last winter, and he imposed fewer pandemic restrictions than did former New York Gov. Andrew Cuomo.

The Covid data tracking outfit Rational Ground calculated that the 25 states with most in-person learning during the 2020-2021 school year gained 822,064 people on net from other states. It’s impossible to quantify precisely the cause-and-effect impact of school closures and lockdowns on population migration. But the correlation is clear from the data.

There’s also the impact of rising taxes. Although Washington State (which has no income tax) before the pandemic had been drawing people from other states, it saw a small net outflow this past year. Gov. Jay Inslee’s severe lockdowns and school closures are probably culprits. But the state isn’t helping by imposing a 7% tax on capital gains exceeding $250,000 that will take effect Jan. 1. Remote work has made high earners more mobile, and raising their taxes is fiscally self-destructive.

Mr. Cuomo is the king of self-destruction. In the spring he signed legislation raising income taxes on individuals making more than $1 million even as tax revenues surged. The top state-and-local combined rate climbed to 14.8% from 12.7% on income of more than $25 million. Good luck to Eric Adams, New York City’s mayor-elect, who is forced to plead with high earners to return from Florida.

Many GOP-led states including Tennessee, Idaho and Arkansas have cut taxes during the pandemic. More than a dozen such as Georgia, Missouri and West Virginia also expanded school choice, as did a few governed by Democrats such as Kansas and Pennsylvania.

The pandemic—let’s hope—is a once-in-a-lifetime event. It has caused enormous social and economic upheaval, along with population shifts that won’t repeat every year. Yet it has also heightened the distinction between Republican lawmakers who strive to protect individual freedom, even amid crisis, and Democrats who impose more government control.

Differences in policies and political values won’t recede with the virus, and it’s clear from the census data which side is winning the contest for talent and taxpayers.

OIL:

U.S. oil production set to increase further in 2022, energy expert Dan Yergin says

Abigail Ng, CNBC, December 29, 2021

KEY POINTS

- “For the last year, year and a half, it’s been OPEC+ running the show, but U.S. production is coming back already, and it’s going to come back more in 2022,” said oil expert Daniel Yergin.

- Output could rise as much as 900,000 barrels per day, he told CNBC’s “Squawk Box Asia” on Wednesday.

- Yergin also discussed the Jan. 10 security talks between U.S. and Russian officials.

U.S. oil production is back and set to increase in 2022 after more than a year of OPEC and its allies “running the show,” according to Daniel Yergin, vice chairman of IHS Markit.

Output could rise by as much as 900,000 barrels per day, he told CNBC’s “Squawk Box Asia” on Wednesday.

U.S. oil firms slashed production in 2020 as the coronavirus pandemic destroyed demand and supply has not yet recovered to pre-Covid levels. In 2019, the U.S. produced 12.29 million barrels of crude oil per day, according to the U.S. Energy Information Administration.

That figure was 11.28 million in 2020 and is estimated to be 11.18 million in 2021 and 11.85 million in 2022.

“The U.S. is back,” Yergin said. “For the last year, year and a half, it’s been OPEC+ running the show, but U.S. production is coming back already, and it’s going to come back more in 2022.”

He added that he has been on two calls where the U.S. energy secretary asked companies to increase production.

“That, of course, is because the Biden administration is so deeply concerned or alarmed about inflation, and about its political impacts,” he said.

Yergin also predicted oil prices will stay in the $65 to $85 per barrel range and that $100 oil is unlikely “unless some big geopolitical turmoil happens.”

International benchmark Brent crude futures were up 0.49% at $79.62 on Thursday morning in Asia, while U.S. crude futures gained 0.47% to trade at $76.92.

U.S.-Russia relations

Yergin also discussed the Jan. 10 security talks between U.S. and Russian officials.

Tensions at the Russia-Ukraine border have been high for weeks, and the U.S. and European allies have been alarmed by the buildup of Russian troops.

U.S. President Joe Biden and Russian President Vladimir Putin spoke via video call on Dec. 7. Putin asked that Ukraine be denied membership in the North Atlantic Treaty Organization — but the U.S. did not accept that demand.

There likely isn’t any intention for NATO to accept Ukraine into the alliance, but there’s a need for “strategic ambiguity,” Yergin said.

“Ukraine’s not going to become part of NATO, but … you can’t have Vladimir Putin dictating that to you,” he added.

The question is how to reach an agreement that “saves face for everybody,” he said.

Negotiations will be tough, but “at least they are having conversations,” said Yergin.

GAS:

Alaska Connection:

Fuel for Thought: Alaska looks to ammonia from natural gas as part of energy transition strategy

DOE’s First $1B Loan Guarantee in Years Seeks to Bolster Turquoise Hydrogen Process

Sonal Patel, Power, December 29, 2021

The Department of Energy’s (DOE’s) first conditional loan guarantee offered to a non-nuclear project since 2016 will finance the expansion of a pioneering commercial-scale “turquoise hydrogen” and carbon black production facility in Nebraska.

The agency’s Loan Programs Office (LPO) on Dec. 23 offered a commitment to guarantee a loan of up to $1.04 billion under the LPO’s Title XVII Innovative Energy Loan Guarantee program to Monolith, a 2012-established firm that has developed a methane pyrolysis process to convert natural gas into hydrogen and high-purity carbon black using renewable energy. Carbon black, a solid carbon material, is a critical raw material in the automotive and industrial sectors.

Assuming Monolith fulfills certain conditions, the DOE intends to issue a final loan to help the company expand its Olive Creek facility (Figure 1) in Hallam, Nebraska, and boost its production capacity to 194,000 metric tons per year. Engineering, construction, and procurement (EPC) giant Kiewit is slated to spearhead construction of the project.

DOE LPO Director Jigar Shah said last week the Monolith project represents “the first-ever commercial-scale project to deploy methane pyrolysis technology, which converts natural gas into carbon black and hydrogen—two products that are frequently used in difficult to decarbonize industrial sectors like tire and ammonia fertilizer production.” The Monolith project “can potentially catalyze a new and cleaner way of producing materials that go into a lot of our everyday products,” he said.

Shah also notably hailed the announcement as a “re-emergence” of LPO as “DOE’s lending authority that can accelerate the development and deployment of clean energy technologies.” While the DOE already has “dozens of active applications under review,” the recently enacted $1 trillion Bipartisan Infrastructure Law expanded LPO’s loan authority and broadened the pool of eligible borrowers for the program, he said, suggesting more announcements should be expected next year.

A Pioneering Methane Pyrolysis Process

Monolith’s methane pyrolysis process has been much-watched by entities across the world since the company kicked off its efforts in 2013 to scale up a technology it purchased from Norwegian company Kværner (now Aker Solutions). Kværner deployed the first and only commercial-scale methane pyrolysis facility using hot plasma in 1997. Kværner’s facility, however, was decommissioned in 2003 owing to insufficient quality of carbon black product.

Monolith has in recent years gained the capital backing of Japanese technology giant Mitsubishi Heavy Industries (MHI), Azimuth Capital Management, Cornell Capital, Imperative Ventures, Warburg Pincus, Perry Creek Capital, SK Inc., and utility giant NextEra Energy Resources. MHI, which invested in the company to diversify its hydrogen value chain, told POWER that Monolith’s process solves a “century-old” problem of scaling methane pyrolysis to a commercial level.

Monolith’s methane pyrolysis process essentially uses natural gas as feedstock, but unlike blue hydrogen, which involves its combustion, Monolith uses thermal plasma (hot plasma) to heat natural gas’s methane molecules in the absence of oxygen using renewable power (acquired through renewable energy certificates). The process uses relatively high temperatures (of more than 800C) to crack the CH4 molecules to cleanly separate them into hydrogen and carbon (Figure 2).

“Per unit of hydrogen produced, methane pyrolysis uses three to five times less electricity than electrolysis; however, it requires more natural gas than steam methane reforming,” the International Energy Agency (IEA) noted in its October-released Global Hydrogen Review 2021. “The overall energy conversion efficiency of methane and electricity combined into hydrogen is 40–45%.”

Monolith has refined its technology since 2017, when it was proven at a demonstration-scale at Monolith’s Seaport pilot facility in California. In 2020, the company began operations of Olive Creek 1 (OC1), its first commercial-scale emissions-free production facility designed to produce approximately 14,000 metric tons of carbon black annually along with clean hydrogen. The company in 2020 also announced its plans to produce emissions-free ammonia at a second phase production facility known as Olive Creek 2 (OC2) in Hallam, Nebraska. Documents suggest OC2 should be online in 2024 to produce 180,000 metric tons of carbon black. A third plant may also be under development (Figure 3).

“Our expansion in Nebraska will include a clean ammonia production facility, which will produce approximately 275,000 tons of ammonia annually. This helps fill a 1.75-million-ton deficit in the U.S. Corn Belt, a significant player in feeding a growing world population. From there, applications are endless, including transportation fuel, industrial and steel manufacturing applications,” Monolith said.

Interest in Turquoise Hydrogen Is Growing

While Monolith’s process is noteworthy for its regional applications and end-uses for carbon black, hydrogen, and ammonia, several other facilities are also spearheading methane pyrolysis around the world. Australia-based Hazer Group is, for example, planning to convert biogas into hydrogen and graphite at a demonstration plant for its catalytic-assisted fluidized bed reactor technology. In May 2021, German chemical firm BASF and power company RWE announced they would develop a project to convert 7,500 GWh produced by a proposed 2-GW offshore wind farm for methane pyrolysis, electrical cracking for petrochemical production, and power-to-heat at BASF sites in Germany. Russia’s Gazprom is also reportedly developing a cold plasma–based process for methane pyrolysis.

U.S-based startup C-Zero, a company backed by Bill Gates’ clean-energy fund, in July 2021 meanwhile announced plans to launch a pilot project by the end of 2022. C-Zero says it is developing a “drop-in” system that can be placed between the existing natural gas infrastructure and industrial natural gas consumers.

Asked about the economics of “turquoise hydrogen,” Dr. Fadl Saadi, director of Business Development and Operations at C-Zero, in a July 2021 live stream at the Atlantic Council said methane pyrolysis may not be as competitive with steam methane reforming, but it’s “very competitive compared to steam reforming plus carbon capture and sequestration (CCS).” Compared to green hydrogen, methane pyrolysis is “especially interesting” because, from a thermodynamic perspective, it needs seven-and-a-half times less energy to split methane into carbon and hydrogen. “That 7.5-times differential for energy requirements is absolutely massive in an energy and commodity space, especially when we’re talking about producing significant amounts of hydrogen globally,” he said.

Scaling up, however, will require a more nuanced balance, Saadi suggested. “We think finding a way to make sure that as we scale up this technology, maintaining that energy differential benefit will be critical for methane pyrolysis,” he added. “We think if you ended up needing just as much energy as electrolysis but now you also have to buy the natural gas and worry about the upstream emissions, and then you have a solid carbon they need to dispose of, that this technology no longer becomes economically competitive.”

The DOE’s Re-emergence as a Clean Energy Financier

If finalized, the conditional loan guarantee offered to Monolith will be the DOE’s thirtieth under Title XVII of the Energy Policy Act of 2005. Title XVII has generally supported projects under two separate loan guarantee authorities. The 2005 law authorized $23.9 billion for Section 1703 to boost “innovative” clean energy technologies, including nuclear, coal, and renewables—but the program ultimately secured only one project commitment: $12 billion to shareholders to support the Vogtle nuclear expansion in Georgia. Section 1705 was created by the American Recovery and Reinvestment Act of 2009 to support the rapid deployment of renewable energy, transmission, and biofuel projects, but it expired in September 2011 after committing funds to 28 projects.

POWER’s analysis shows more than $14 billion of financial support was provided under Section 1705. The limited utilization of Section 1703 is mainly attributed to its requirements that projects employ new/significantly improved technologies, and that borrowers—due to limited appropriations—pay either a portion or the entire subsidy cost.

However, the DOE last week suggested that LPO has made “substantial changes to improve the program that has now attracted more than 66 loan and loan guarantee applications, valued at more than $53 billion in clean energy and advanced vehicle technology projects.” The Bipartisan Infrastructure Law also expanded the LPO’s authority, it said.

Changes include updates to processes, work to solicit new projects, and due diligence on potential loans in support of the DOE’s work to deploy clean energy, said Shah. “LPO’s rigorous due diligence has resulted in a portfolio loss ratio of just 3.3% to date, to accelerate the advancement of American innovation, a mixture of successful projects and losses is expected,” he noted.

MINING:

World’s first school for holistic mining management incorporates ESG agenda

Amanda Stutt, Mining. Com, December 29, 2021

Demand for copper to fuel the green energy transition is forecast to average 13% annual growth over next 10 years, according to analysts. Arizona – which produces 74% of America’s copper – will soon be home to a new type of institution designed to shape the industry’s workforce for the future.

The University of Arizona’s (UA) School of Mining and Mineral Resources in Tucson was approved by the Arizona Board of Regents this year and the Arizona State Legislature approved $4 million in ongoing yearly funding.

Tucson is in proximity to mines like Freeport-McMoRan’s Morenci, the largest copper producer in the state, and is a technology hub for mining — it is headquarters to major suppliers such as Caterpillar, Komatsu and Hexagon.

The UA’s School of Mining will be the first institution in the world to rely on a holistic approach to mineral resource management, incorporating a focus on environmental, social and governmental (ESG) issues. The UA is ranked third in the nation among mineral and mining engineering programs and home to the San Xavier Underground Mining Laboratory, the only mining lab in the US with a working vertical shaft.

“The whole idea of the school came about because the University of Arizona is in a unique position to cross-pollinate mining knowledge with other critical fields. We’re known for creating an interdisciplinary center for mining research and education,” Moe Momayez, Associate Professor of Mining and Geological Engineering at the University of Arizona told MINING.com.

The School features programs such as Global Mining Law, the Centre for Environmentally Sustainable Mining and the Geotechnical Center of Excellence.

“I think the School is going to be the vehicle that is going to allow us to promote mining to students and stakeholders — I see the school striving to change the public perception of mining,” Momayez said. “I realize that’s a tall order, but the director is going to have a full team.”

Aside from courses, students spend time in St. Xavier underground mining lab, “a unique facility that we use to train our students, provide them with hands-on experience, we do mine ventilation, mine safety and health, rock mechanics, ground support, equipment maintenance.”

Momayez said the lab is heavily instrumented, with sensors monitoring the mine environment and is expanding to be able to bring in larger equipment in the cross section.

“We can stream data out of the mines so the students and researchers can have real time system data,” he said.

Momayez pointed out the minerals the world needs to power the new green economy need to be mined to build the needed solar panels, wind turbines and electric cars, and that the minerals key to daily life are all traced back to the mines, while acknowledging a wide mainstream public misconception of mining.

“The reality is we’re going to need minerals for decades, centuries to come if we are going to sustain the same levels of economic prosperity.”

Momayez said that it is not only students and the wider public that need to be educated, but also politicians and non-governmental agencies.

“They are the ones that need to realize, the basis of our civilization is mining. And we cannot sustain our lives, our civilization, if we stop mining,” he said.

President Joe Biden promoted the need to establish critical minerals domestic supply chains, but major mining projects are being halted in the US and new royalties on the industry introduced.

Related: Senators blast new US mining royalty plan as anti-green, pro-China

“On one hand, everyone is saying critical minerals are very critical to the future and the security of the nation, but on the other hand, they don’t help the mining industry,” Momayez said.

“That is where I think we need to reach out to the politicians, the government, and begin educating them about mining, and the role that mining plays. I see a huge gap there that needs to be filled.”

POLITICS:

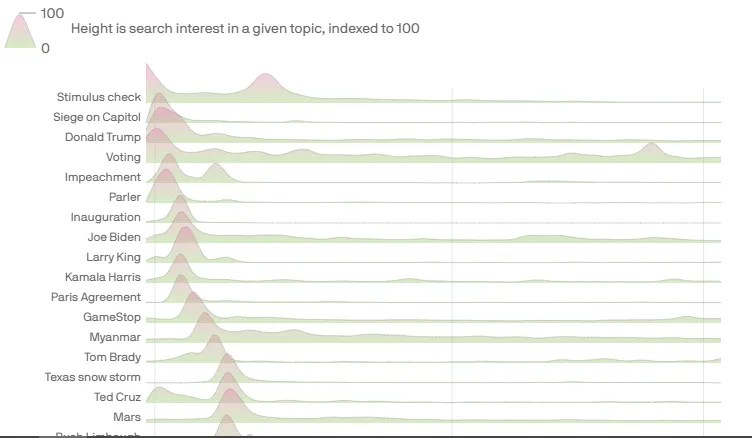

The relentless 2021 news cycle in one chart

Stef W. Knight, Axios, December 30, 2021

Google Trends for 2021 news topics

Dec. 27, 2020, to Dec. 18, 2021, weekly

Between a siege on the Capitol building, a Texas snowstorm, Brood X cicadas, the Olympics, and a stuck container ship in the Suez Canal — not to mention endless COVID variants — it’s been a busy year.

Why it matters: In the inaugural Axios-Google Trends news cycle chart, we chronicled the unprecedented first year of President Trump. Four years later, Joe Biden is president and the themes have changed, but America’s short attention spans and rapid breaking news cycles continue.

By the numbers: The single topic to receive the highest percentage of Google searches all year was the Olympics, during the week of its opening ceremonies.

- Next came searches about stimulus checks at the very start of the year, followed by searches related to Trump during the week of Jan. 6.

- Searches related to Biden and the COVID-19 vaccine rounded out the top five topics overall, out of more than 50 major 2021 events and topics chosen by Axios.

COVID never left our searches over the course of the year.

- Google measures search interest on a scale of 0-100, which reflects the percent of total Google searches dedicated to a topic. Searches for COVID-19 vaccines never fell below 5 on that scale, even when compared to dozens of spiking topics over the entire year.

- Searches related to shootings also never fell below 5.

Between the lines: Overall, most major events or issues this year only managed to keep America’s attention for one or two weeks.

- The death of Larry King, sex trafficking allegations against Rep. Matt Gaetz, the Suez Canal debacle, Israel’s bombing of a building housing the AP, and the fall of Kabul to the Taliban each had about two weeks when they made up high percentages of Google searches — before attention started to move elsewhere.

- There were some exceptions, including in mid-March when searches for “Stop Asian Hate” surged for multiple weeks in response to the Atlanta spa killings and in mid-April when the coronavirus ravaged India.

- From mid-May to early June was cicada season — both in our backyards and on search engines. Shortly after, interest in critical race theory reached its peak and remained high for several weeks.

What to watch: The topics that stick or surge at the right time could have an important role in next year’s mid-term elections.

- There was relatively high and sustained interest in topics like crime and the border this year — favored midterm talking points by the GOP. However, it was largely in line with interest over the last five years.

- Biden’s Build Back Better plan received a recent spike of attention recently, but it has had relatively little national interest compared to the other times on the list.

Go deeper: Visit our past projects for 2017, 2018, 2019 and 2020.

CLIMATE CHANGE:

Energy competition will deliver the best outcomes for customers and our climate in 2022

Steve Forbes, FOX Business, December 29, 2021

With world leaders focused intensely on the shared challenge of climate change, much was expected of that recent COP26 summit in Glasgow. The results were, to put it mildly, thoroughly disappointing as participants failed to gain consensus on any real groundbreaking pledges.

Despite an underwhelming COP26, Democrats stateside continue to push their own climate measures with a reconciliation bill that contains billions in proposals and tax increases they hope will define America’s energy future. While some proposed solutions are simply too costly, others are destructively impractical, threatening to derail the nation’s burgeoning energy economy and saddle customers with skyrocketing energy costs.

The good news is that there are better, proven solutions that will support access to low-cost energy and a market-based transition to clean energy. For example, energy markets and their customers would benefit tremendously from increased competition. To get there, we’ll need to initiate conversations at both federal and state levels about policy options that encourage and institutionalize competition in our electricity markets, moving us away from vertically integrated, monopoly utility markets that are outdated and inefficient.

There is transformative power in competition especially when applied to our nation’s electricity grid. However, many markets today lack competition altogether. These are vertically integrated markets made up of utilities with a monopoly on power generation.

On the other hand, some markets foster competition for electricity generation among wholesale market participants. In these competitive markets, multiple generators and independent power producers in a wide region compete to drive the best outcomes for consumers and the environment.

In terms of cost, the competition enshrined in the wholesale model has proven effective in driving down costs for customers. A recent paper from the Pacific Research Institute, a California-based think tank, found that families and businesses lose out financially when states cling to the outdated monopoly model.

Comparatively, the Institute found that electricity prices in competitive markets are trending downward and were at or near 6-year lows as of 2020 in regions like New York, New England, and the mid-Atlantic. This contrast – whereby competitive markets have benefited by more affordable electricity versus monopoly states – is mostly because monopoly utilities set rates to maximize returns for shareholders, instead of setting rates to attract customers.

Competitive markets are also a positive force for the deployment of more renewable power, a move that we will need to foster naturally if the U.S. is to meet the climate goals being pursued by leaders of both parties.

That was one of the messages sent earlier this year to the Federal Energy Regulatory Commission (FERC) by nine former commissioners of that body, who argued that competitive markets were critical to “a least-cost customer-centric transition to a low carbon or zero-carbon grid…” Data supports that claim, as a recent analysis by the University of Texas-Austin’s Dr. Joshua Rhodes found that competitive market regions are reducing carbon emissions faster than monopoly regions.

Statistics matter, but so does real-life evidence. In Pennsylvania, for example, competitive market power generator Calpine Corp. began providing reliable power to the state and the rest of the PJM market in 2019 from its dual-fueled, natural gas combined-cycle electric generating facility York 2 Energy Center. As Calpine’s CEO noted, the plant will “operate cost effectively without the need for government or public subsidies, demonstrating that letting the competitive markets work is the best way to optimize generation resources.

Conversely, monopoly utilities are not inherently structured to meet cost or environmental objectives. They’re prone not only to stifling progress but have been found guilty on more than on occasion of the kind of corruption we routinely ascribe to the word “monopoly.”

Ohio-based FirstEnergy Corp., for example, was forced to pay millions of dollars after admitting to conspiring to pay off public officials in Ohio in exchange for action on policies that would benefit FirstEnergy Corp. In the end, the company agreed to pay a $230 million monetary penalty, but not after customers of the company paid the bill for their power provider’s wrongdoing.

As federal and state lawmakers look for consensus on moving the needle on climate change, they should look to regional wholesale and retail market competition to enable the progress they want, rather than trying to force through with mandates and expensive taxes.

Competition has proven capable of saving customers money and helping the environment. Policymakers should encourage policies that allow markets to work, unleashing the power of competition rather than burying American taxpayers with taxes and costs they can’t afford.