Today’s Key Takeaways: North Slope, Beaufort Sea lease sales attract Oil Search Alaska, LLC, Great Bear Petroleum Ventures and Hilcorp. China turns away from Alaska to Russia for discounted oil. Agrium’s existing infrastructure can produce conventional liquid ammonia as part of Alaska Hydrogen Hub. 49 of 50 critical minerals can be found in Alaska. What do election results mean for energy policy?

NEWS OF THE DAY:

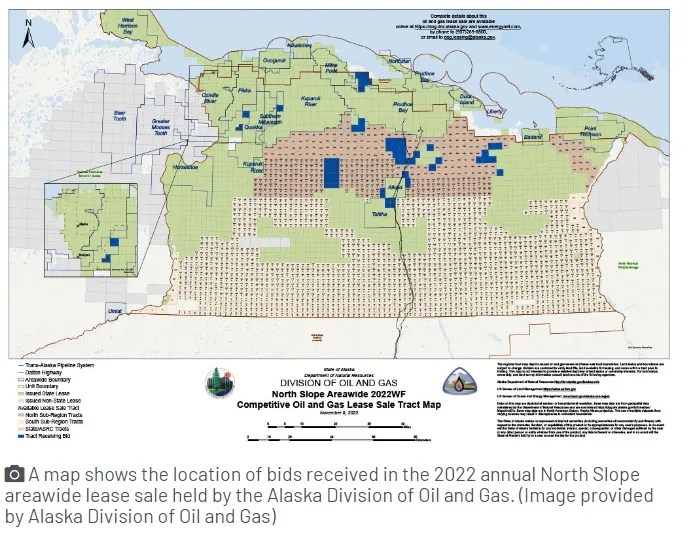

State oil lease sales draw more than $5 million in bids for North Slope and Beaufort Sea

Yereth Rosen, Alaska Beacon, November 10, 2022

Businesses spent more than $5 million for leases giving them the right to explore for oil on state-owned territory in the Arctic, the Alaska Department of Natural Resources announced on Wednesday.

The 2022 areawide North Slope lease sale held once a year by the Division of Oil and Gas was the main attraction, with 63 bids received for 61 tracts and over $4.5 million offered in high bids for 121,412 acres, the department said. A simultaneous state Beaufort Sea sale drew $575,146 in bids for 17,212 offshore acres, the department said.

In a statement, the department touted the preliminary results as good for the state economy and the Alaska Permanent Fund, the state-owned oil wealth account.

“Alaskans will be pleased to see the oil resource that seeds critical investments like our permanent fund is continuing to enjoy international interest and support,” Acting Natural Resources Commissioner Akis Gialopsos said in the statement.

The average bids per acre — $37.28 for the North Slope and $35.41 for the Beaufort Sea – were among the highest per-acre amounts in the history of the state’s areawide leasing program, the statement said. The Beaufort Sea is the portion of the Arctic Ocean north and east of Utqiagvik and west of the Canadian islands.

Measured by total dollars offered in high bids, however, it was one of the least lucrative state North Slope lease sales held since the first areawide lease was held in 1999. Only six areawide North Slope sales yielded lower total high bids. Some totals were substantially lower, such as the sale held a year ago, which drew only six bids totaling $467,472 in total high bids.

Among the active bidders were Oil Search (Alaska) LLC, which picked up tracts near its newly formed Quokka Unit on the western North Slope, and Great Bear Petroleum Ventures, which picked up tracts near its Alkaid and Talitha prospects south of Prudhoe Bay.

OIL:

China Replaces Alaskan Expensive Crude With Russian Oil

Robert Tuttle, Bloomberg/Rigzone, November 10, 2022

China’s passion for Alaskan oil appears to be over as the country turns to Russia.

Surging Chinese energy demand amid Covid lockdowns on the US West Coast prompted Alaskan oil exporters to ship more crude than any time in two-decades, and nearly all of it went to the East Asian country. So far this year, shipments have almost dried up entirely. Just a single cargo sailed aboard the Seaways Sabine to China in March, according to Vortexa Data.

Unlike Russian oil that is sold at a discount due to sanctions, Alaskan oil has traded at its biggest premium to the US benchmark since 2014 this year.

There is “just a general lack of interest from the traditional buyers in China,” Rohit Rathod, a Vortexa analyst, wrote in an email. “Those buyers have mostly likely turned away from ANS in favor of cheaper Russian ESPO crude.”

India boosted purchases of discounted Russian barrels after the invasion of Ukraine at the expense of oil from other parts of the world, such as Canada

GAS:

Agrium & Alaska LNG Project Identified As Key Components To Hydrogen Hub Proposal

KSRM News Desk, November 9, 2022

The conceivability of a re-opening of the Agrium plant in Nikiski and the construction of the Alaska LNG Project LNG facility in Nikiski, based on the two facilities abilities to produce hydrogen in quantities sufficient for a U.S. based Hydrogen Hub, was lined-out in an announcement by the Alaska Gasline Development Corp. (AGDC) in a statement released on November 7th.

The Alaska Gasline Development Corp. (AGDC) announced submission of a concept paper for an Alaska Hydrogen Hub to the U.S. Department of Energy (DOE).

Kenai Peninsula Borough Mayor Mike Navarre describes how the Alaska Hydrogen Hub would affect the Kenai Peninsula Borough;

“It would have huge impact because it presumes that the Gasline from the North Slope down is built. That is the only way they get projects off the ground. That’s certainly something we have been hoping for, for a number of years. Whether or not this particular effort comes to fruition, I don’t know enough about it yet to make that determination. I think certainly it’s a step on the right direction as to whether we see any construction starting, even that not going to take place immediately there’s still a lot of work to be done.”

Federal funding to create hydrogen hubs was included in the 2021 Bipartisan Infrastructure Law, passed with the support of Alaska’s Congressional Delegation, and signed by President Biden, and is expected to be awarded in late 2023 or early 2024. DOE envisions selecting six to ten hydrogen hubs and awarding up to $7 billion in federal funding to support the production and delivery of clean hydrogen energy in support of U.S. emissions-reduction goals.

Alaska Organizations supporting the AGDC-led Alaska Hydrogen Hub include Agrium U.S., Salamatof Native Association, Alaska CCUS Consortium (including ASRC Energy Services, Santos, and Storegga), and the University of Alaska Fairbanks’ Alaska Center for Energy and Power.

According to AGDC the existing energy infrastructure located in the idle ammonia plant owned by Agrium can produce Hydrogen in the form of conventional liquid ammonia which emits no carbon dioxide when used to produce energy and is easier to store and transport than hydrogen gas.

Mayor Navarre discusses the impacts to the Kenai Peninsula Borough;

“Kenai Peninsula Borough will be the biggest impacted area, because we have the facility here, the gas facility will be built here and a new dock facility also, never mind the other infrastructure. The Borough has to be involved because we’re going to be directly impacted in terms of the number of people who move here both to build the facilities and also then to work for them. We’ll be the biggest area impacted in the State, so we should get significant revenues.”

Alaska’s Cook Inlet, in the center of the Alaska Hydrogen Hub, has an estimated 50 gigatons of carbon sequestration capacity, the best carbon sequestration potential on the West Coast.

Combining Agrium with Alaska’s North Slope, AGDC believes Alaska has a number of advantages that make the region uniquely suited to host one of the new U.S. hydrogen hubs.

For further details on the proposal click here.

MINING:

49 critical minerals in the 49th State

Shane Lasley, North of 60 Mining News, November 4, 2022

Of the 50 minerals deemed critical to America’s economic wellbeing and national security, only one is not found in Alaska

From antimony historically mined near the Interior Alaska city of Fairbanks to the zinc and germanium produced at the Red Dog Mine, America’s 49th State is a past producer, and a potential future source of the minerals and metals deemed critical to the United States.

Earlier this year U.S. Geological Survey updated and expanded its list of critical minerals to include 50 minerals and metals essential to the economic or national security of the U.S. and which has a supply chain vulnerable to disruption.

Alaska currently produces two of the critical minerals on this list – zinc and germanium – and is prospective to produce 47 others.

Interestingly, aluminum is the only commodity on the U.S. critical minerals list that has not been found in any appreciable quantities in Alaska.

“All the way back to the days of the Gold Rush, Alaska has been famous for its mineral wealth,” said U.S. Geological Survey Director David Applegate.

“The Last Frontier remains a frontier for critical mineral resource development,” he added.

Here is a rundown of the 49 critical minerals that are found across America’s Last Frontier.

POLITICS:

MIDTERM ELECTION ROUNDUP: WHAT DO THE RESULTS MEAN FOR ENERGY POLICY?

Tim Tarpley, Energy Workforce and Technology Council, November 9, 2022

At time of writing Wednesday, final control of both the House and Senate are still up in the air, but there are a few takeaways we can conclude at this point, especially about what it means for Energy Workforce issues and Member Companies for the next two years.

The first major takeaway is that Republicans had a bad night, significantly underperforming their own goals, as well as the traditional political expectations in a midterm election year with a President whose approval rating has been hovering in the low 40% range. Just a few weeks ago, expectations were high that Republicans would see a 40-50 seat majority in the House, and this is clearly not going to be the case.

As far as specific impacts let’s begin with the House. As of now, Democrats have locked in 186 wins and Republicans 202. Control of the House requires 218 seats, so Republicans need to win at least 13 of the seats that are still in play. This is doable, but not guaranteed at this point. The important thing from the sector’s perspective is that if Republicans ultimately do prevail and take back the House, the margin is going to be razor thin. Looking at the outstanding races, it would be safe to assume that if Republicans are ultimately successful, the best guess on a margin would be somewhere in the 220-225 range at this point. That is razor thin.

With such tight margins, Rep. Kevin McCarthy (R-CA-23) will almost certainly face an internal challenge both from his right and left for the ultimate Speaker position. If he prevails in this challenge, which is far from a sure thing at this point, he will face a very difficult caucus to govern. With such tight margins, the minority wings of the caucus will wield tremendous power.

What does this mean for energy policy in such a House? Assuming McCarthy holds on and does become speaker, he will spend much of his time and political capital trying to hold on to that seat. While we still can expect investigations of the Biden Administration to remain front and center, there may be more of an internal struggle as to what the focus of these investigations should be.

We can expect the Freedom Caucus to wield more power and jockey for committee gavels in return for support. We can also expect appropriations battles to be more difficult with such small margins. Policies like the ESG SEC rule may be more likely to survive such a small-margin House. It will be difficult (especially if Senate does not flip) for a House with that makeup to successfully pushback on the rule using appropriations. Additionally, we may see environmental regulations such as the methane rule survive in such as a House as well. Democrats will only need to pick up a few votes in order to protect any particular provision on an appropriations package.

The Senate appears to be even closer and may be up in the air for some weeks. As of now, Republicans appear to control 49 Senate seats and Democrats 48. The big surprise was John Fetterman pulled off a big win in Pennsylvania. This race will ultimately be important to the final control of the Senate. On energy policy, we should note that Fetterman has expressed support for fracking and to a lesser extent LNG exports, so policy-wise we are not likely to see significant change on those issues from his Senate office.

Votes are still being counted in Nevada and Arizona, but it is beginning to look like Senate control could ultimately hinge on the outcome of the Georgia Senate race. Georgia law requires one candidate to receive 50% plus one to avoid a runoff and it looks very unlikely that either candidate will pull that off at this point. This means we will not know who controls the Senate until December 6, the date of the runoff in Georgia.

For our purposes, ultimate control will have less effect than the fact that it will be very slim margins. From a practical standpoint, either way most legislation will shut down in the Senate. We can expect very little to happen in the next two years. There may be a window for a bipartisan permitting reform package at some point but considerable compromise on both sides will likely be needed. We may also see some last-minute deals cut with Sen. Joe Manchin (D-WV) or others to try and jockey for ultimate power.

Finally, we must ask ourselves what are the results going to mean for President Biden and his energy policies? This it seems will be a mixed bag. If the President avoids a massive beating (like it appears he will), many of his advisors that have been pushing an aggressive anti-oil and gas set of policies may be emboldened. Polling indicated these policies were extremely unpopular and could lead to rout at the polls. If this rout is avoided, we may see a doubling down on some of these policies by the administration.

With electoral pain seemingly dulled, it will be up to the potential minority in the House to pushback and use their investigative tools as aggressively as they can in the next two years. We can expect a game of cat and mouse in that scenario, where executive agencies attempt to shield much of their actions in regulatory actions. From our perspective, watching all regulatory actions and working with House allies to pushback on overreach will become extremely important. Most of our battles over the next two years will be of a regulatory nature.

While votes are still being counted and final takeaways perhaps a few weeks away, the initial takeaway for our sector is mixed. We certainly didn’t see the strong pushback against the Administration that many had hoped for, however we also didn’t see a full-fledged bear hug of the Administration by the American public either. We look to be heading into two years of divided government, and sometimes that can be alright for industry. Legislation will slow down … and things may just get a bit more predictable for a while.